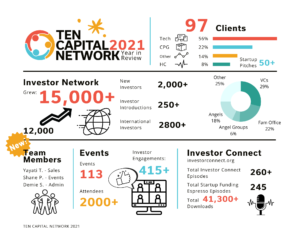

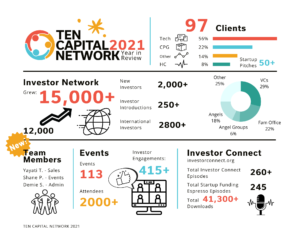

TEN Capital 2021: Year in Review

2 min read As 2021 continued to be a year of uncertainty and challenges, we at TEN Capital are thriving. As the investment world stabilizes,

2 min read As 2021 continued to be a year of uncertainty and challenges, we at TEN Capital are thriving. As the investment world stabilizes,

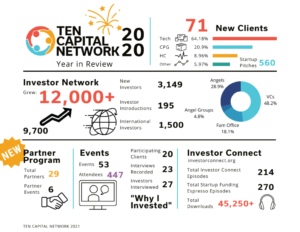

2 min read As we take a look at the 2020 year in review, we see a year of change, uncertainty, and challenges. It was