Investor Connect Interview: Ander Iruretagoyena of Impact Engine

2 min read On this episode of Investor Connect, Hall welcomes Ander Iruretagoyena, the Senior Associate at Impact Engine. Headquartered in Chicago, Illinois, Impact Engine

2 min read On this episode of Investor Connect, Hall welcomes Ander Iruretagoyena, the Senior Associate at Impact Engine. Headquartered in Chicago, Illinois, Impact Engine

2 min read As a startup investor, it is imperative that you are considering the exit strategy before beginning the investment as this is what

2 min read: A common funding source for launching and growing a business is equity funding. However, equity funding is expensive. Luckily, there are many

2 min read As an investor, you receive your most significant return on investment when your startup investment takes its exit. But, is your startup

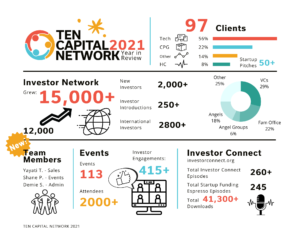

2 min read As 2021 continued to be a year of uncertainty and challenges, we at TEN Capital are thriving. As the investment world stabilizes,

2 min read Investing in CPG The CPG space is a solid one to invest in, especially in a post-COVID era. There are specific cues

3 min read Let’s look at some trends in CPG in this Post-COVID World. The consumer packaged goods sector consists of companies that manufacture and

2 min read How COVID-19 is Driving the Fintech Sector How COVID-19 is Driving the Fintech Sector As the COVID pandemic passes, we emerge into

1 min read Cryptocurrency in the Fintech Space. Fintech is a giant industry that spans lots of different segments. When you say FinTech, you’re talking