2 min read As 2021 continued to be a year of uncertainty and challenges, we at TEN Capital are thriving. As the investment world stabilizes, startups and growth companies continue to seek Capital, and new companies are formed every day to meet the demands of an increasingly remote workforce.

At TEN Capital Network, we were fortunate enough to welcome three new team members. Yayati has come aboard to take over our outreach efforts. Shane took the reins of our events, helping them to grow in number and popularity. We also welcomed Demie, who stepped up to assist cross-departmentally with the extra workload.

TEN Capital in 2021

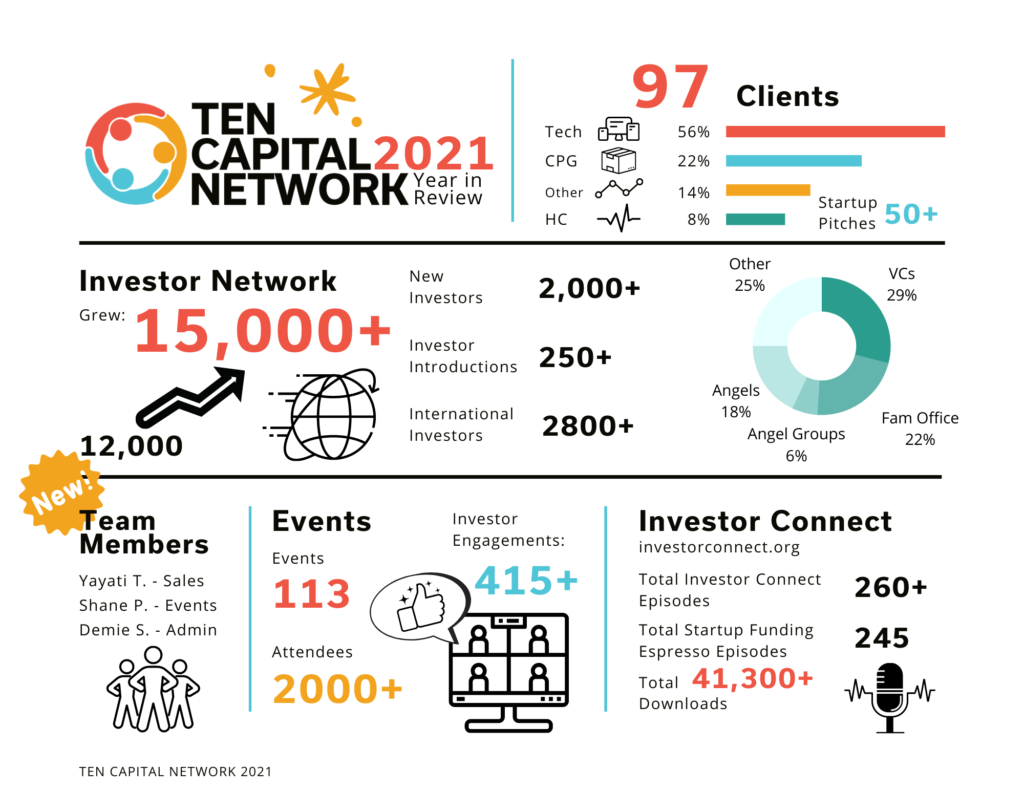

Since January of this year, we gained 72 new ideal Clients out of 477 Startup pitches.

We started the year with 12,033 investors and are heading into 2022 with over 15,000. Our investor network includes VCs, Angels, and Family Offices each investing in the Tech, Healthcare, CPG, Energy, and a variety of other spaces.

TEN Fundraise Launch

The TEN Capital Fundraise Launch Program is a self-paced program that helps startup and growth companies prepare a fundraise campaign.

In addition to self-paced training, TEN holds monthly online meetings for answers to your specific questions about valuations, target investors, and readiness for approaching investors. Each month, come prepared with your burning fundraise questions and we’ll answer them in real-time.

Do you need help preparing for your fundraise? Speak to a representative today about the TEN Fundraise Launch Program. Click Here

TEN Capital Partners

TEN Capital introduced our Partner Program in 2021 and today it is thriving. We are thankful to our inaugural partners that have been integral in helping us grow this year, including Arora Project, Investable Mastermind, Kickfurther, New Mexico Angels, Title3Funds, INNP Consulting, Kiwitech, CrowdVision Advisors, LLC, Wiss Early Stage, Keiretsu Forum.

Events in 2022

2021 was a big year for TEN Capital Events.

Since January, we have hosted 113 events with over 2,100 attendees leading to over 400 unique investor engagements for our clients.

We welcomed 87 guests, hosts, panelists, and speakers through formal webinars to casual networking style, virtual events.

In 2022, we are kicking into high gear with several new event formats, including TEN Fundraise Launch, TEN Capital Club, TEN Capital Quick Pitch, Angel Investor Insights, The Future of Funding Series, and more.

Check out these and all of our upcoming events on our website: https://www.startupfundingespresso.com/events

TEN Capital for Crowdfunding

On top of our current programs, TEN Capital now helps you prepare your equity crowdfunding campaign.

We can help you:

- Select the right crowdfunding platform(s)

- Set funding goals with milestones to achieve.

- Set up a promotions budget

- Outline the plan for updates every two weeks — what news to post and when

- Website review (most investors will research your deal by visiting your website)

- Update your profile in investor databases such as Crunchbase and others.

Speak to a representative today to see how TEN can help your Crowdfunding campaign. Speak to someone today!

NEW! Investor Connect Non-Profit

TEN Capital and Investor Connect are proud to Introduce Investor Connect Non-Profit. Make a difference!

Your donation will go towards educating investors and startups about startup fundraising. Pay it forward with your donation to this cause. We do not charge any fees for this content. We rely upon your donations to extend this work. Donate Now!

This Year on Investor Connect and Startup Funding Espresso

Top 10 Investor Connect Episodes of 2021:

10. Episode 617 – Mike Audi of TIKI Inc.

9. Episode 620 – Sam Silvershein of Alpha Partners

8. Episode 634 – Brian Parks of Bigfoot Capital

7. Episode 616 – Richard Teideman Angel Investor

6. Episode 627 – Sarah Jennings of Beyond Angel Network

5. Episode 618 – Dr. Raymond Levitt of Blackhorn Ventures LP

4. Episode 625 – Adam Haber, Angel Investor/Trellus

3. Episode 614 – Ross Darwin of Owl Ventures

2. Episode 608 – Julio Moreno of Santa Cruz Angeles

1. Episode 469 – Archie Cheishvili of GenesisAI

Top 5 Startup Funding Espresso Episodes of 2021:

5. How to Manage the Deal Process

4. Five Key Elements to a Startup Story: The Hero

2. SAFE Notes vs. Convertible Debt

1.How to Prepare for the Next Raise

From the TEN Marketing Department

While we had a lot of great content in 2021, there were a few standouts based on feedback from the network:

Top 10 Blog Posts for 2021:

10. How to Secure Investor Funding

8. 10 Reasons an Investor Will Pass on Your Deal

6. The Most Common Reasons Why Startups Fail to Raise Funding

5. 5 Signs Your Startup Isn’t Ready to Raise Funding

4. SAFE Notes vs. Convertible Debt

3. 5 Things Investors Love to Hear in a Pitch

2. Pitching Angel Investors: Competition & Competitive Advantage

1. The Convertible Note: How Does it Work?

Top 5 eGuides of 2021:

5. How to Craft a Startup Story

4. Due Diligence and Leading the Deal

2. Negotiations and Valuations

So from all of us at TEN Capital (Demie, Sam, Yayati, Shane, Lilia, Caitlin, and Hall), we hope you have a healthy, happy, and prosperous 2022.

Hall T. Martin is the founder and CEO of the TEN Capital Network. TEN Capital has been connecting startups with investors for over ten years. You can connect with Hall about fundraising, business growth, and emerging technologies via LinkedIn or email: hallmartin@tencapital.group