TEN Capital Early Exit Deal Structure is Pure Alpha

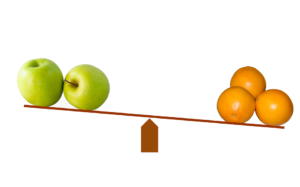

1 min read TEN Capital Early Exit Deal Structure is Pure Alpha In the financial world of investment, there’s alpha and beta. Alpha is a measure of return on investment with a comparison to the market. Beta is a measure of volatility and how the investment moves relative to the rest of the market. In short, alpha is how well your investment performed on its own while beta is how well your investment performed as a function of the entire market moving in one direction or the other. At TEN Capital we work with early-stage startups and use an investor redemption right to provide early exits from startup investments. This tool provides pure alpha as there is no liquid market for early-stage companies. Later stage companies can be bought out or go public but that takes many years and only a small fraction of those companies make it there. As an early-stage investor, you can still participate in the startup funding world by using the TEN Capitals’ early exit structure. We’ve recently opened an online platform to post early exit investment opportunities, including a pitch deck, deal terms, diligence documents, and updates about the company. The platform uses a Special Purpose Vehicle (SPV) to collect investor interest for a fundraise. You can read more about and request access to the TEN Capital Early Exit Syndicate Platform here: http://staging.startupfundingespresso.com/spv/ Hall T. Martin is the founder and CEO of the TEN Capital Network. TEN Capital has been connecting startups with investors for over ten years. You can connect with Hall about fundraising, business growth, and emerging technologies via LinkedIn or email: hallmartin@tencapital.group