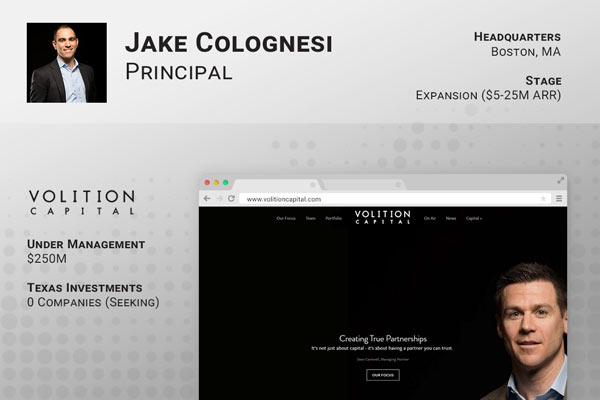

Headquarters: Boston, MA

Sectors: Software, Enterprise Software, E-Commerce, Internet, Mobile, Data Services

Description: Volition Capital, a growth equity firm that focuses on founder owned companies in the technology sector and holds true to just that. With 75 years of collective investing experience and assets invested in a portfolio made up of 22 companies that are approximately worth $300 million, Volition Capital proves to be not only your investors, but a reliable partner. They truly help founders obtain growth for their companies and also aims to maintain the original vision the founder(s) had. Volition Capital does so with a tool belt that contains one of there most robust tools they call ‘Capital +.’ This tool is an aggregate of their knowledge and resources which is well equipped to make them the ‘Batman’ of growth equity firms.

“At Volition Capital, one of our values is to treat other people as you would want to be treated yourself. It is a very simple piece of wisdom by which we abide. Often, when we face a difficult decision, we ask ourselves how we would want to be treated in that situation and act accordingly. We believe that at the end of the day, all we have is our reputation and we engage with other people with that fully in mind.”

Recent Investments:

- Prinova $17M / Venture (Lead)

- Assent Compliance $20M / Venture (Lead)

- LoanLogics $10.03M / Series B

- Pramata $10M / Series A (Lead)

Website: http://www.volitioncapital.com/

Jake Colognesi the Principal at Volition Capital had active roles in securing t he investments at Prinova and Loanlogics.

he investments at Prinova and Loanlogics.

Prior to joining the firm in July 2011, Jake spent two years attending the Tuck School of Business.

He also worked as an Associate for Fidelity Ventures and as an analyst in the Technology, Media, and Telecommunications Group at Cowen and Company.