Headquarters: Menlo Park, California

Sectors: Marketing Technology, Financial Technology, Consumer, Energy, Software, Enterprise Software, Clean Technology, Design

Description: Foundation Capital was founded in 1995. This venture capital firm is dedicated the proposition that one entrepreneur’s idea, with the right support, can become a business that changes the world. Their current total funds raised are at $607M. They invest in seed, early stage venture, late stage venture, private equity, and debt financing investments. Foundation Capital is currently invested in more than 60 high-growth ventures in the areas of consumer, information technology, software, digital energy, financial technology and marketing technology.

“We are, quite simply, a venture capital firm where the venture matters more than the capital. Where purpose, and hard work, count.”

Recent Investments:

- Revlo $2M / Seed

- Brave $6M / Seed

- Skycure $16.5M / Series B (Lead)

- ForUsAll $9.5M / Sereis A (Lead)

Website: www.foundationcapital.com

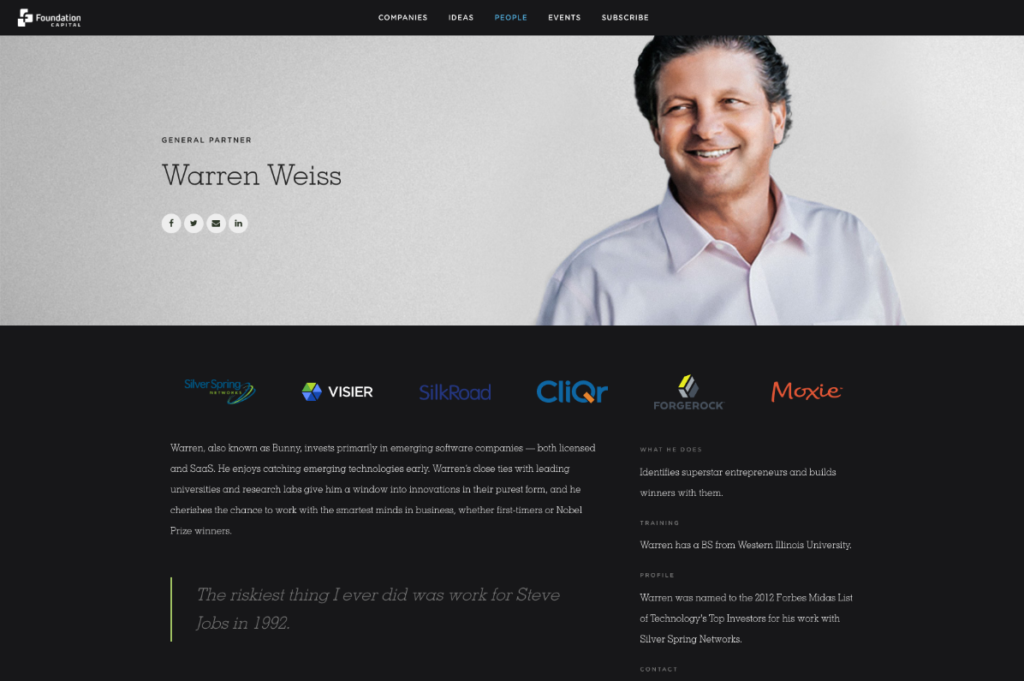

Warren Weiss, also known as Bunny, invests primarily in emerging software compa nies — both licensed and SaaS. He enjoys catching emerging technologies early. Warren’s close ties with leading universities and research labs give him a window into innovations in their purest form, and he cherishes the chance to work with the smartest minds in business, whether first-timers or Nobel Prize winners.Warren is on the boards of Trufa, Cyphort, ForgeRock, Moxie Software, SilkRoad Technologies, Silver Spring Networks, and Visier.

nies — both licensed and SaaS. He enjoys catching emerging technologies early. Warren’s close ties with leading universities and research labs give him a window into innovations in their purest form, and he cherishes the chance to work with the smartest minds in business, whether first-timers or Nobel Prize winners.Warren is on the boards of Trufa, Cyphort, ForgeRock, Moxie Software, SilkRoad Technologies, Silver Spring Networks, and Visier.

His past investments include CliQr Technologies (acquired by Cisco), eMeter (acquired by Siemens) and MarkMonitor (acquired by Thomson Reuters).

Warren identifies superstar entrepreneurs and builds winners with them. He was also named the 2012 Forbes Midas list of Technology’s Top Investors for his work with Silver Spring Networks.