There are many parallels between the blockchain/crypto world of today and that of the Dotcom era of the 90s. I often hear comments such as “It’s 1994 and it’s deja vu- all over again”. The hype, hysteria, and ultimate bubble popping of 2001 still remain a vivid memory for many.

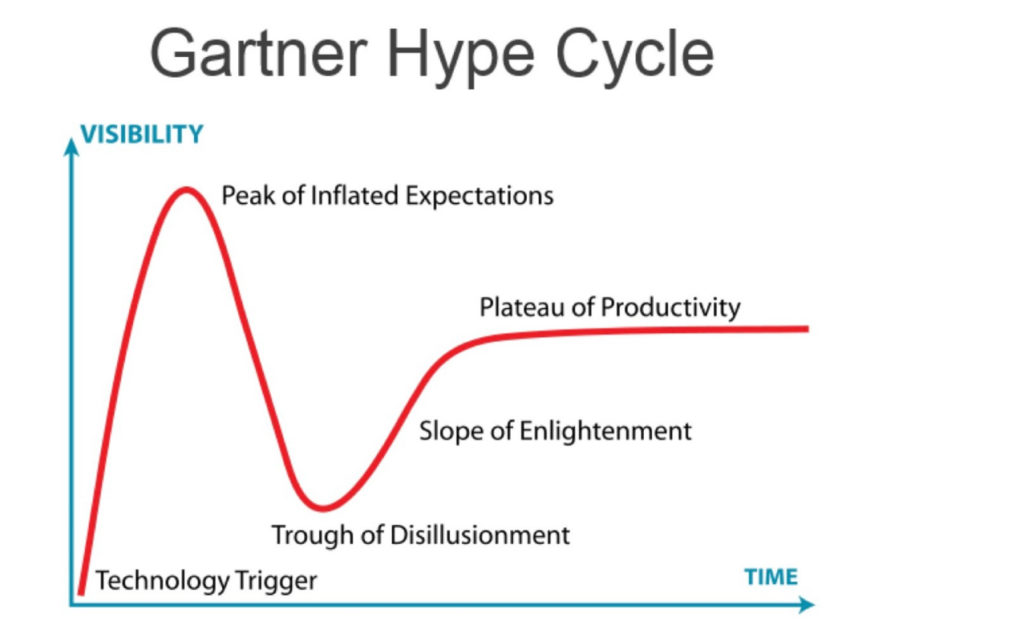

Crypto and blockchain are on the same trajectory with all the associated hype, media mania, and startup hysteria that comes with it. The Gartner Hype curve is one way to track our progress through the inevitable cycle of launch, fall back, and then finding the way forward.

Here’s the Gartner Hype Curve for those not familiar with it.

It does seem to me that blockchain is progressing more quickly through the hype curve than the Dotcom era. I guess more people know the stages and execute in a “fail fast” mode so as to move to the next phase more quickly. Also, the tools for propagating information (social media, email, other) are better so it leads to reason that we’ll make our way up the curve faster.

As with all new technologies, the surrounding ecosystem needs to be built out and this will some take time. Most crypto solutions today focus on infrastructure. High-end point applications are going to be difficult to build until the foundations are in place. Enabling tools and technologies need to be put in place.

These are important points to remember in evaluating ICOs on offer. In reviewing the current crop of ICOs it appears some are trying to put a man on Mars with the blockchain equivalent toolset of a 1985 PC and DOS. This is going to be tough. As an investor, you don’t want to invest in a startup for first timers launching a mission to Mars – you want the A-team going for a slam dunk on their home field.

It will take some time, but that time clock seems to be moving faster than before.

Hall T. Martin is the founder of TEN Capital and a builder of entrepreneur ecosystems by startup funding through angel networks, funding portals, syndicates, and more Connect with him about fundraising, business growth, and emerging technologies.

Hall T. Martin is the founder of TEN Capital and a builder of entrepreneur ecosystems by startup funding through angel networks, funding portals, syndicates, and more Connect with him about fundraising, business growth, and emerging technologies.